Why Us?

Ready To Invest In Property But Short On Funding?

As true in-house private money lenders, we offer speedy and flexible funding solutions based solely on your property equity. With Lensz Capital, you’ll experience a fast and efficient lending process, tailored to your unique needs, so you can focus on making the most of your investment opportunities.

Contact us today to unlock the potential of your property investment with our in-house private money lending solutions.

Choosing Lensz Capital is an easy decision.

See why we are the Most qualified company for the job!

-

Experienced 1

Over $500MM funded to successful Real Estate Investors.

-

Trusted 2

America's most trusted Investment Lender since 2013.

-

Easy to Work With 3

Add a professional Investment Coach to your team.

-

Best Terms 3

We have the Lowest Investment Loan Rates Guaranteed! Don't miss out on the best rates in the nation!

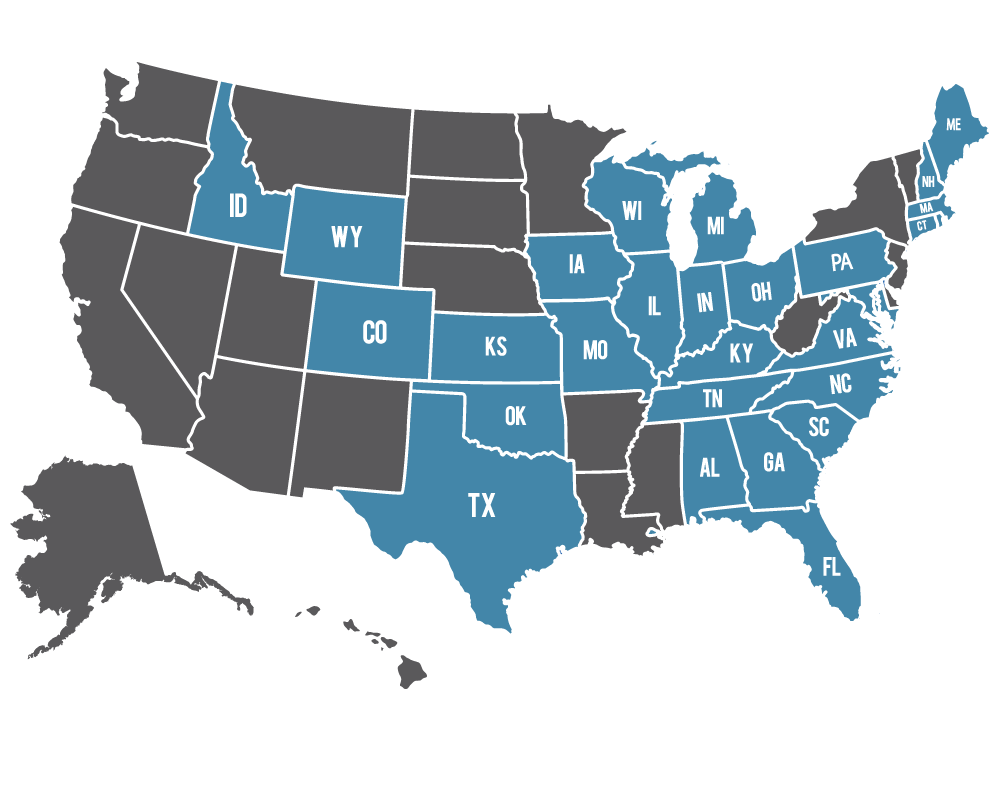

Lensz Capital Lending Map

States Where We Lend

States Where We Currently Don't Lend

America's Most Trusted Investment Lender Since 2013

Over $500 Million Provided to Investors by Our Staff of Loan Professionals.

Lowest Investor Loan Rates Guaranteed!

Here's why our rates are better

Contact us to learn more

*DISCLAIMER:

We strive to give our customers the best price and service possible. If you happen to find a better price for your loan before you commit, please LET US KNOW – we will match the price of ANY competitor.

Loan Estimate from competing lender must be dated and received within 3 calendar days of submission to Lensz Capital. The terms of the competing loan must be identical (product and term) to Lensz Capital’s loan. Offer is only valid in states where Lensz Capital is currently originating loans.

The rates must be within the range of interest rates that we are currently quoting. Amounts on the Loan Estimate may still vary within regulatory tolerances from the closing disclosure based on findings in underwriting, and all loans are subject to credit approval.

Lensz Capital reserves the right to rescind or modify the terms of this offer without prior notice.

Download our free guide to using Private Money for your Real Estate Investing.

Don't waste another minute in a bank!

It’s the center of everything we do, everything we teach and everything we want for our financial clients and our investors.

Enter the “Circle” anywhere. Enter it as a “newbie” real estate investor, or enter it as an experienced one. You can enter as a borrower or a lender, or even an Internet marketer. We want to explain to you how we can get you traveling along the ‘Circle of Wealth.

We provide borrowers with access to private capital for investing in real estate It’s the ‘Circle of Wealth.’ It’s what we do!